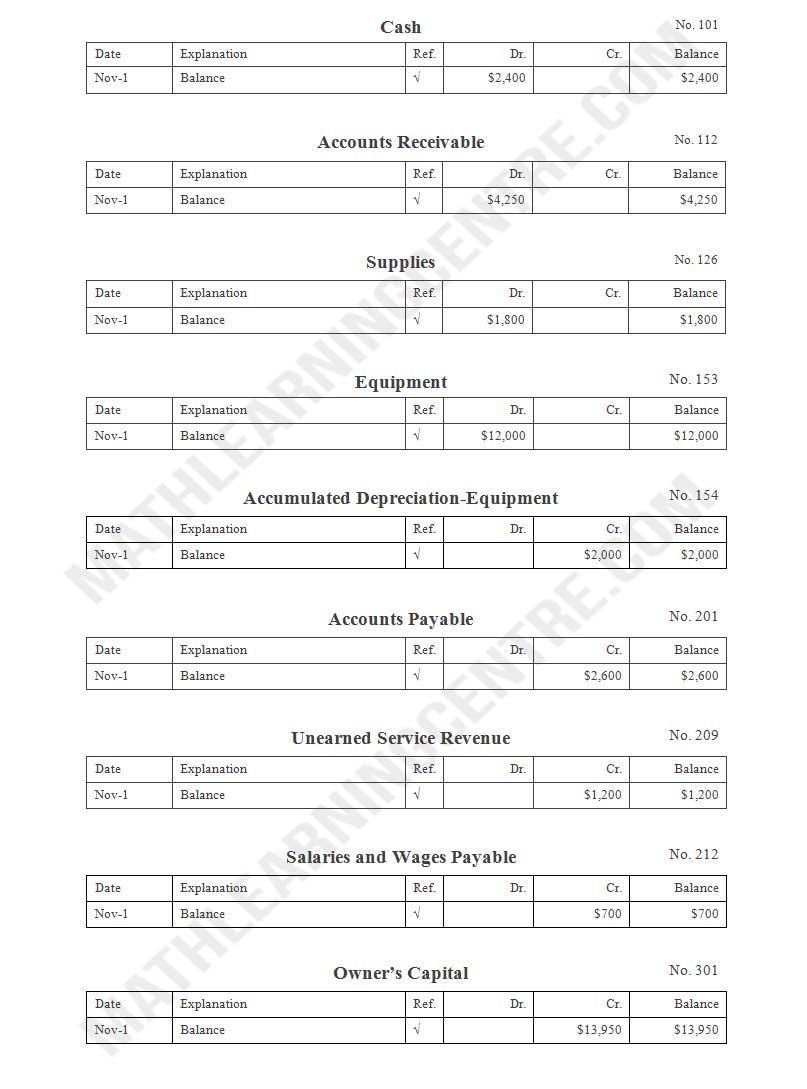

On November 1, 2017, the account balances of Hamm Equipment Repair were as follows:

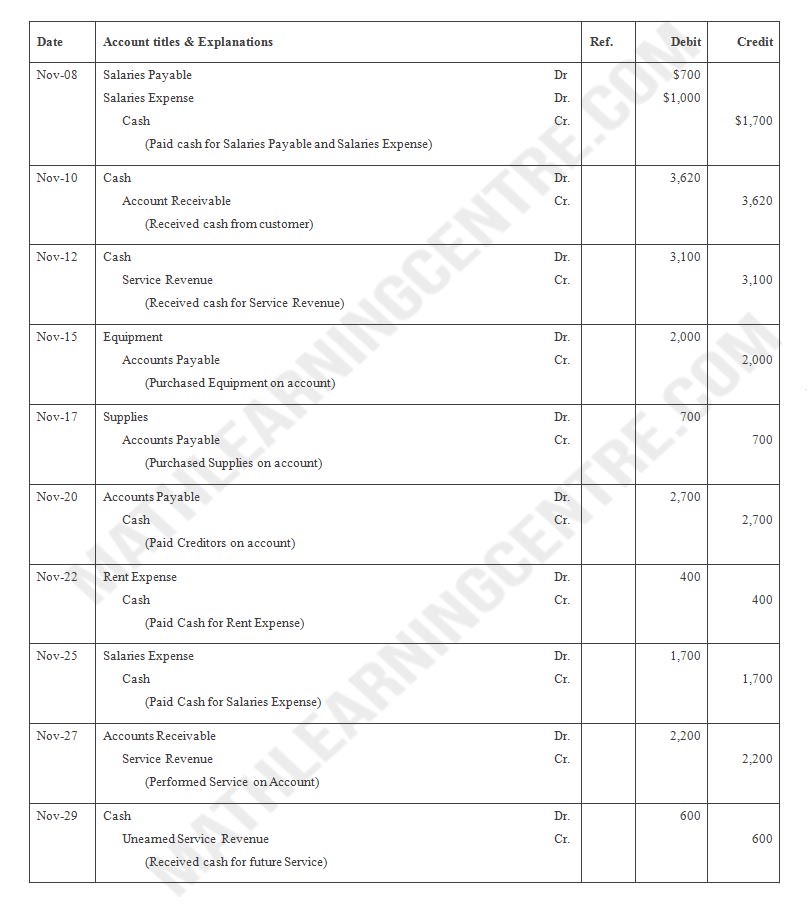

During November, the following summary transactions were completed.

Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries.

10 Received $3,620 cash from customers on account.

12 Received $3,100 cash for services performed in November.

15 Purchased equipment on account $2,000.

17 Purchased supplies on account $700.

20 Paid creditors on account $2,700.

22 Paid November rent $400.

25 Paid salaries $1,700.

27 Performed services on account and billed customers for these services $2,200.

29 Received $600 from customers for future service.

Adjustment data consist of:

1. Supplies on hand $1,400.

2. Accrued salaries payable $350.

3. Depreciation for the month is $200.

4. Services related to unearned service revenue of $1,220 were performed.

Instructions:

(a) Enter the November 1 balances in the ledger accounts.

(b) Journalize the November transactions.

(c) Post to the ledger accounts.

(d) Prepare a trial balance at November 30.

(e) Journalize and post adjusting entries.

(f) Prepare an adjusted trial balance.

(g) Prepare an income statement and an owner’s equity statement for November and a balance sheet at November 30.

Thanks